Economists, including Nobel laureates, have convinced society that inflation is good and deflation is bad. Hackers, cyberpunks, crypto-anarchists, and libertarians beg to differ, believing inflation to be theft.

Bitcoin was meant to be a response to the 2008 financial crisis and an opposition to the monetary policies of central banks. However, it became more than just a currency, an asset, a facilitator, and a means to protect capital from inflation. It led to a revolution on the internet. In this article, we will explain what motivated Satoshi Nakamoto in creating Bitcoin.

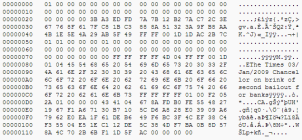

Genesis Block

The first block in the Bitcoin blockchain contains a message from the headline of “The Times” newspaper from January 3, 2009: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”. This message also serves as a timestamp, ensuring that the first block wasn’t mined earlier than that particular day.

Satoshi didn’t choose this article by chance – it talks about the government plans to bail out banks with public money so that, after the collapse of Lehman Brothers, other poorly managed banks wouldn’t crash. The creator of Bitcoin commented on the government’s reactions to information published by Julian Assange: “WikiLeaks has kicked the hornet’s nest, and the swarm is headed towards us”[1].

In 2002, at a conference dedicated to open-source software, Richard Stallman, founder of the free software movement (GNU), stated: “Geeks like to think they can ignore politics. You can leave politics alone, but politics won’t leave you alone”[2]. He emphasized that governments won’t allow systems that operate outside the regulatory framework.

Debt-based economy

The creation of central banks, numerous crises, world wars, departure from the gold standard, speculative bubbles, and inflation robbing people of their savings – all significantly influenced the growing economic polarization of society and the establishment of a new global order. In this new setting, the majority of wealth went into the hands of a small group. “All these were effective means to take control not only of resources and goods but, above all, people and their work”[3], commented J. Białek in the book. Time of Slaves. How the world became owned by a few corporations.

Thomas Jefferson, one of the founding fathers of the United States, had already warned against entrusting private money to banks. He said, “These banks, through inflation and then deflation, will deprive citizens of their property until one day, when their children wake up and realize that the great nation built by their fathers was lost”[4].

Alan Greenspan, chairman of the Federal Reserve System (FED) from 1987-2006, said in 1966: “Without the gold parity, there’s no way to protect savings from confiscation through inflation. […] Financial policy by a welfare state requires that wealth holders cannot protect themselves in any way”[5].

Early bankers, driven by natural human greed, designed the banking system to maximize benefits, disregarding the interests of businesses, society, and government institutions. “Widespread trading of government debt on international financial markets subjugates the states that have incurred these debts to the dictate of international finance. A significantly reduced sovereignty of state authorities in these countries threatens democracy and exposes countries to losses”[6].

The introduction of new money into circulation by states through quantitative easing, forced by this system, accelerates the debt spiral. If economic growth slows or stops, such as in a crisis, then – as R. Adamus notes – “the result of a collapse in state finances and budget deficit usually is inflation or even hyperinflation”[7].

The debt-based economy made not only individuals hostages to central banks. Commercial banks, companies, governments, and corporations became slaves as well. Central banks’ “virtual” money, which is not backed by gold, is referred to as fiat money (from the Latin “fides” – trust or faith). The history of “paper money” dates back to ancient times. Ludwig von Mises, a prominent economist of the Austrian School of Economics, believed that for a financial system to be stable, it should be based on a metal standard: “He criticized inflationary policy, which leads to an artificial market boom, not resulting from the actual strength of the economy.”[8]

The world has been in crisis since 1971

Following the Bretton Woods agreement in 1944, which influenced the establishment of a new global economic order and a return to the gold standard, the dollar’s convertibility to gold was again suspended in 1971.

The development of central banking systems has made the once-natural gold parity fade into oblivion, giving way to a debt-based economy. The Bretton Woods system was replaced by the SDR-based system, and the link between currencies and gold became history. The suspension of the dollar’s convertibility to gold affected all sectors of the economy and led to inflation growth.

Banks gradually began to implement inflationary policies aimed at increasing consumption and the pace of money circulation in the economy. Inflationary policy then became an integral part of banking systems in most countries worldwide: “Every time, the ideal system evolved into a mixed system that, in addition to the standard medium of exchange, also allows fiduciary money operations, such as banknotes, deposits, or government bonds.If fiduciary money appears in circulation, taking control by the state is practically inevitable.”[9]

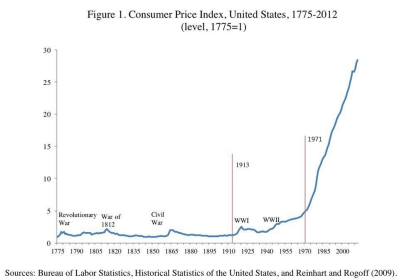

On the wtfhappenedin1971.com website, numerous charts have been published illustrating the impact of the events of 1971 on the economy. The following chart shows the price increase in the United States after 1971.

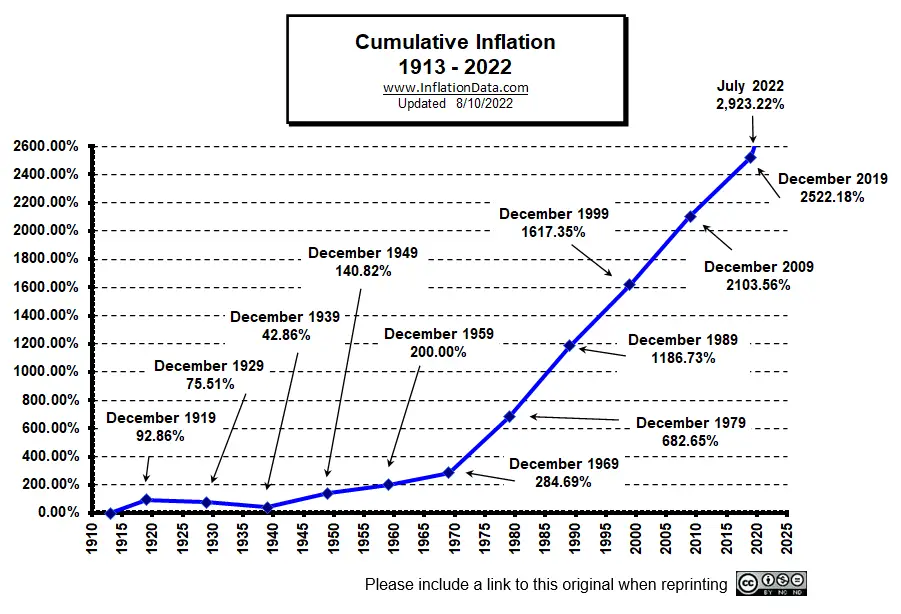

On the inflationdata.com website, one can analyze the cumulative inflation chart in the United States over the last century. By mid-2022, it had reached almost 3000%.

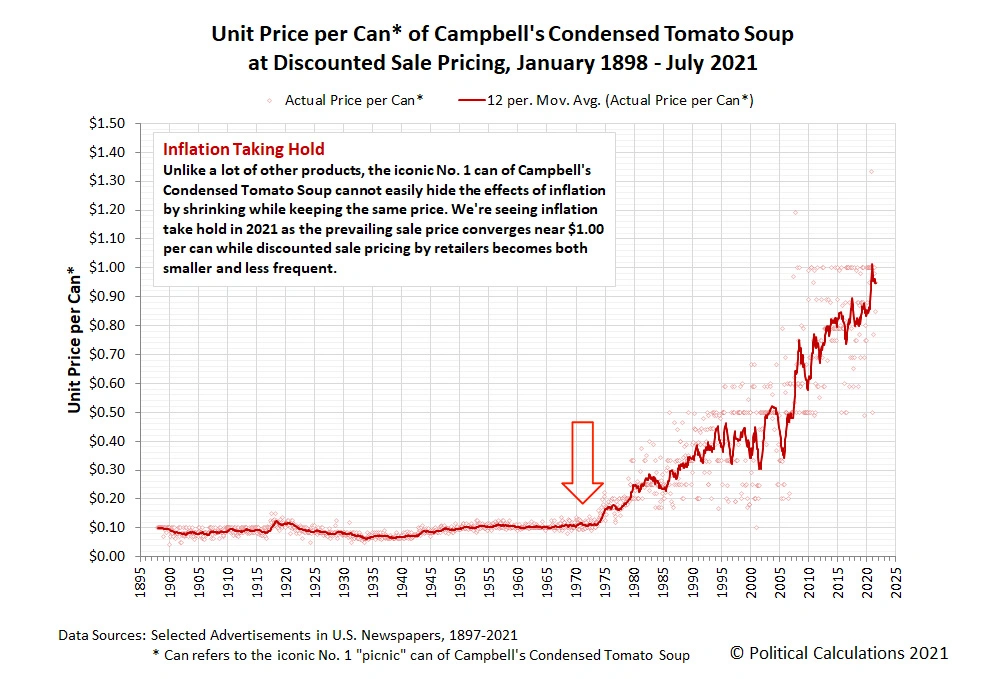

This can be compared with the chart showing the price increase of popular canned tomato soup.

J. Foster and W. McChesney note that: “Since 1970, there have been at least 15 serious cases of financial disturbances.” [10]Worth noting are the Asian Financial Crisis in 1997, the crisis caused by the malfunctioning of the Long Term Capital Management fund in 1998, as well as two 21st-century crises. Older generations also remember the dot-com bubble: “The bursting of the stock market’s dot-com bubble in 2000 seriously weakened the U.S. economy, which was only saved from a much greater disaster by the rapid emergence of a real estate market bubble in its place.”[11].

The Great Financial Crisis of 2007-2009 was caused by the policies of banks, driven by an addiction to economic growth, granting high-risk mortgage loans, known as subprime. What’s worse, the solution to the crisis, triggered by the collapse of Lehman Brothers, became currency dilution.

Massive printing

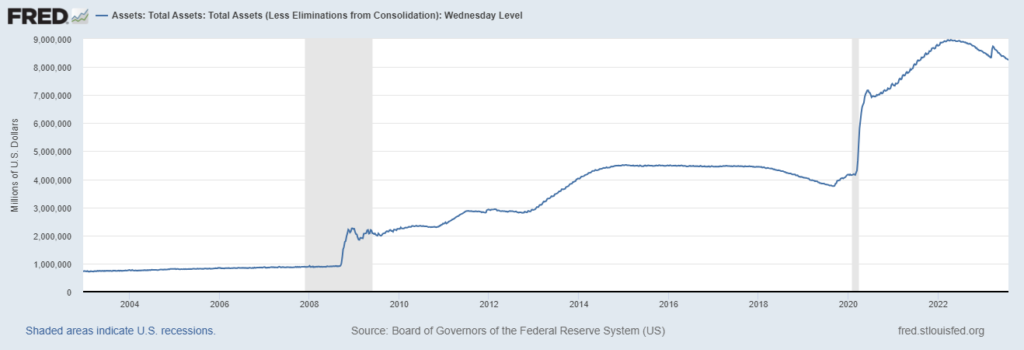

The policy of massive money printing, also known as Quantitative Easing (QE), is a strategy introduced by many central banks, including the Federal Reserve in the U.S., the European Central Bank, and the Bank of Japan, to increase the amount of money in circulation, lower interest rates, and stimulate the economy.

The U.S. government, not wanting to allow further bankruptcies, began rescue operations, financing financial institutions close to bankruptcy. “Not only did they reap the amounts from the bailout operations, but every day they legally collect huge amounts of public money as part of their regular operations.”[12]. Most importantly, “without the rescue operations, many banks would be worthless today. If their shares were traded on the stock exchange, their price would be mere pennies.”[13]. The governments of the United States, China, and European countries, in order to revive the economy, “adopted economic policies in the spirit of John Maynard Keynes, the intellectual ancestor of Minsky. Following the economist’s suggestion, spending was increased to stimulate the economy, which had the expected effect.”[14].

At this point, it is worth recalling an interesting hypothesis regarding the relationship between toxic debt and political populism, proposed by R. Adamus in the book “Toxic Debt of the 21st Century.” He notes that rulers, “to meet the expected tasks of the state towards its citizens, progressively increase the national debt.”[15].

The price of electoral victories in the form of public debt is passed on to subsequent generations, which can be described as a form of contemporary slavery. Excessive indebtedness leads to inflation, which, by stealing savings from the poorer parts of society, exacerbates social inequalities.

The U.S. began printing more money over the years, pumping stock market prices to historical highs, but this is dwarfed by the scale of printing initiated as a result of the COVID-19 crisis. The following chart illustrates the growth of the M1 dollar supply. It shows that from the beginning of the COVID-19 pandemic to May 2022, the dollar’s monetary base increased more than twofold.

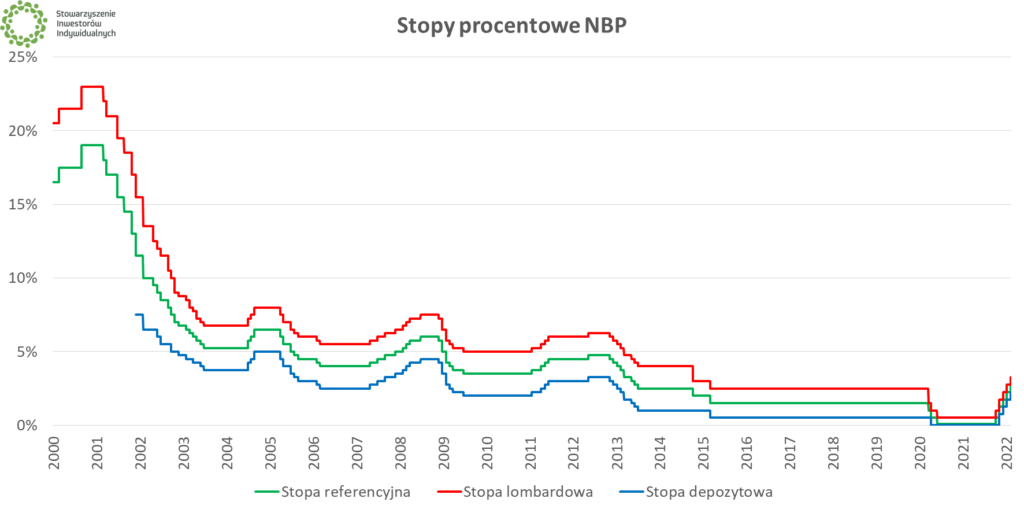

Printing money in response to the crisis is not limited to the United States but also affects most other economies. For instance, the so-called “asset purchase” was even carried out for the first time in history by the National Bank of Poland, which also reduced interest rates during the pandemic, leading to inflation growth. In 2021, interest rates in Poland were the lowest in history, and CPI inflation was the highest since 2001.

In 2022, the NBP began to slightly raise interest rates, but not decisively enough to curb this inflation. It benefits those in power because fighting it would increase the cost of servicing public debt. The increase in the NBP’s reference rates means an increase in debt servicing not only in the government sector but also in the private and corporate sectors.

Additionally, in its report from September 14, 2021, the IIF points out that global debt has risen to nearly 300 trillion USD and has reached the highest level in history.

The Governor of the Bank of Canada, Tiff Macklem, admitted in a public interview that the monetary policy in the form of quantitative easing contributes to the growth of wealth disparities between the wealthiest and the rest of society. [16]. S. Hongbing rightly observes that “this monetary system is a form of cruel punishment for those who save.”[17].

Bitcoin is freedom

F. Hayek in his thoughts on the denationalization of money proposed replacing the state monopoly with competitive, private markets. According to his theory, institutions issuing their own currencies could compete with others, striving to maintain their value. History has shown that reality has developed differently than the concepts formulated at that time, which could be termed economic futurology.

However, in these thoughts, one can discern similarities to the cryptocurrency phenomenon. As noted by T. Swan, Hayek in his 1929 publication “The Paradox of Money” laid the intellectual foundation for the blockchain industry, arguing against the Keynesian theory of inflationary money. In other works, he emphasized that suppliers operating in decentralized markets have a greater ability to respond to buyer needs.[18].

Roger Ver, aka Business Angel, a private investor betting on young businesses, was one of the first to invest in bitcoin and related projects. Due to his contribution to promoting Bitcoin, he earned the nickname “Bitcoin Jesus”. Speaking about the reasons for his fascination with Bitcoin, he stated: “For the first time in the entire history of the world, everyone can send or receive any amount of money, from anyone else, from anywhere in the world, without needing permission from any bank or government.”[19]A perfect confirmation of these words was the transaction on September 13, 2021, where the transaction fee for transferring over $2 billion worth (44598.42992366 BTC) was just $0.78.[20]. Ver emphasized that Bitcoin is an answer to government policies, which can finance wars through inflation: “If the world used Bitcoin, governments would not be able to finance wars through inflation, as they do today.”[21].

Bitcoin reintroduces the idea of rational individualism, giving people freedom of choice, freedom of speech, and protecting property rights. Julia Tourianski, known in the libertarian community and associated with the Canadian Ludwig von Mises Institute, a promoter of anti-state mentality, published the “Bitcoin Declaration of Independence“, thus referencing cyberpunk movements and the “Declaration of the Independence of Cyberspace“, written in 1996 by poet John Perry Barlow.

The declaration, signed by well-known American freedom activists, directly speaks of the anti-government nature of Bitcoin: “Bitcoin is fundamentally anti-establishment, anti-system, and anti-state. Bitcoin undermines governments and disrupts institutional operations because Bitcoin is fundamentally humanitarian. Third-party intrusion is eliminated; it is purely P2P. The blockchain is freedom of speech Bitcoin is decentralized, voluntary, non-aggressive, and it doesn’t aim to operate within the current system. Bitcoin doesn’t need recognition, integration, regulation, or taxation from power institutions. Bitcoin doesn’t bow to power structures. It undermines them.”[22].

The declaration also drew attention to April 5, 1933, which Satoshi Nakamoto listed as his birthdate. On the same day, President Roosevelt issued Executive Order 6102, which under threat of high penalties prohibited US citizens from hoarding gold.

It was a period when America was still grappling with the Great Depression, which began in 1929. Many did not comply with the order and hid their gold. Milton Friedman estimated that “under Roosevelt’s decree, only about 3.9 million ounces were confiscated by authorities, which is roughly 1/5 of the gold in circulation in March 1933.” Interestingly, the same data suggests that gold began disappearing from circulation already from January… three months before the announcement of decree 6102.”[23].

Summary

Macroeconomic factors influence the increasing demand for cryptocurrencies. Bitcoin, created as a response to the crisis, naturally began to be seen as a so-called safe haven – a refuge in difficult times. It didn’t take long for reality to verify the economic determinants of Bitcoin’s emergence. The described policies of central banks and the ensuing assault on private property formed the basis for the first significant macroeconomic event in Bitcoin’s history. By design, Bitcoin was meant to protect people from crises and inflationary policies.

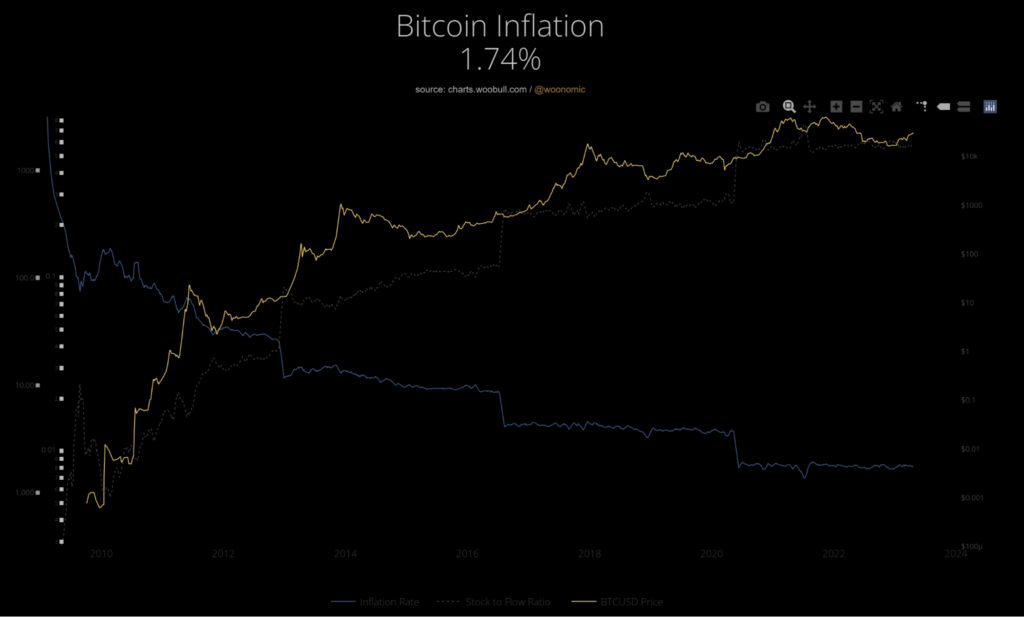

Bitcoin’s supply is halved every specific number of blocks, ensuring that the total monetary base never exceeds 21 million. This is a response to the inflationary policies of banks. For Bitcoin, despite initially very high inflation, reaching several tens of percent in its early years, it currently stands at 1.74%.

In 2023, the monetary base surpassed 19 million coins, reaching 92.587% of the planned emission. Thus, Bitcoin is expected to become a deflationary currency. With a decrease in supply, over time, transaction fees, whose value can be arbitrarily determined by users, will become the primary source of income for miners. A limited monetary base and increasing demand, in accordance with microeconomic equilibrium theory, enforce an increase in Bitcoin’s value in the long run.

________________________________

[1] S. Nakamoto, 11.12.2010 11:39, https://bitcointalk.org/index.php?topic=2216.msg29280#msg29280.

[2] R. Stallman, O’Reilly Open Source Conference: Day 3, 26.07.2002, http://www.apacheweek.com/features/oscon2002.

[3] J. Białek, Time of Slaves. How the world became owned by a few corporations, Wektory Publishing House, Wrocław 2019, p. 203.

[4] S. Hongbing, War for Money. True sources of financial crises, Wektory Publishing House, Kobierzyce 2011, p. 278.

[5] Ibid.

[6] J. Chołoniewski, P. Górnik, M. Siekierski, Banks, money, debts. The unknown truth about the contemporary financial system, Estymator Publishing House Jacek Chołoniewski, Warsaw 2020, p.132.

[7] R. Adamus, Toxic Debt of the 21st Century, Difin Publishing House, Warsaw 2020, p. 77.

[8] D. Juruś, History of private property. From antiquity to modern times, Fijorr Publishing House, Warsaw 2014, p. 246.

[9] M. Friedman, Capitalism and Freedom, Helion Publishing House, Gliwice 2018, p. 95.

[10] J.B. Foster, R.W. McChesney, Endless Crisis. How monopoly-finance capital causes stagnation and shocks from the United States to China, Book and Press Publishing Institute, Warsaw 2014, p. 91.

[11] Ibid.

[12] S. George, Whose crisis, whose answer, Book and Press Publishing Institute, Warsaw 2011, p. 286.

[13] Ibid, p. 288.

[14] N. Kishtainy, A Brief History of Economics, RM Publishing House, Warsaw 2017, p. 271.

[15] R. Adamus, Toxic Debt of the 21st Century, Difin Publishing House, Warsaw 2020, p. 26.

[16] J. Gordon, D. Ljunggren, Bank of Canada says QE can widen wealth inequality, is probing its effects, https://financialpost.com/news/economy/bank-of-canada-says-qe-can-widen-wealth-inequality-is-probing-its-effects-3.

[17] S. Hongbing, War for Money. True sources of financial crises, Wektory Publishing House, Kobierzyce 2011, p. 265.

[18] T. Swan, Blockchain. Foundation of the new economy, Helion Publishing House, Gliwice 2020, p. 137.

[19] R. Ver, Quote, https://www.brainyquote.com/quotes/roger_ver_847270.

[20] Blockchain Explorer, 13.09.2021, https://www.blockchain.com/btc/tx/e09d4bb6c6b30a10b8168ab1f55dcb9b7fd571270f14beea2dcb5fb8dcac967a.

[21] R. Ver, Quote, https://www.brainyquote.com/quotes/roger_ver_847270.

[22] J. Tourianski, The Declaration Of Bitcoin’s Independence, https://bitcoinmagazine.com/articles/declaration-bitcoins-independence-1400096375.

[23] J. Tourianski, How Roosevelt Robbed Americans of Gold, https://bitcoinmagazine.com/articles/declaration-bitcoins-independence-1400096375.