(cover photo – photo by Unsplash)

In today’s globally connected world, technological innovations continuously transform the way we conduct business. Cryptocurrencies, as one of the most revolutionary achievements of the decade, definitely fit into this trend. Almost everyone has heard of cryptocurrencies, yet few people understand them.

We would like everyone to be aware of the changes occurring with the development of Web3. That’s why we have prepared a series of three articles for you, where we will describe the development of cryptocurrencies in the business environment. Our analysis will enable you to deeply understand the topic, whether you are an investor, entrepreneur, manager, or simply a person interested in new technologies.

In the first part, we will delve into the fascinating world of cryptocurrencies and analyze their impact on today’s business landscape. We will discuss the trends that shape this dynamically developing sector.

Global trends

According to the Consensys report from June 2023, 92% of respondents worldwide stated that they had heard of cryptocurrencies, yet only a few percent of those surveyed admitted to understanding this technology. A representative sample of the population of each country was asked 32 questions between April 26 and May 18, 2023. In total, YouGov conducted online interviews with 15,158 people in 15 countries on 5 continents.

While only 8% of respondents declare fluent knowledge of the Web3 concept, many of the remaining respondents support the basic assumptions and solutions of this infrastructure. As many as 50% believe that they add value to the internet, 67% claim that they should own the things they create on the internet, and 79% desire more control over their online identity.

The World Economic Forum (WEF) serves as a platform for discussion and collaboration among leaders from the private sector, government, civil society, and academia around the world.

In addition to annual meetings, WEF conducts many research initiatives, publishes reports and analyses on various global issues, such as economic competitiveness, global risk, and social health. WEF also carries out projects and initiatives focused on specific topics, including the digital economy, healthcare systems, the environment, or sustainable development.

In the context of global impact, the World Economic Forum through its Consortium for Digital Currency Governance recently conducted a thorough analysis of the impact of cryptocurrencies and stablecoins on macroeconomics. The study shows that the vast majority of macroeconomists agree on the key role of digital currencies in modern economies, while simultaneously highlighting the need for appropriate regulation.

The report emphasizes that cryptocurrencies and stablecoins have the potential to create financial stability, equality, and stimulate innovation, as well as promote sustainable development actions. This analysis is a response to growing concerns about potential risks and the impact that cryptocurrencies may have on the global financial system.

It also notes that cryptocurrencies represent new, innovative payment instruments and infrastructure that have the potential to complement or even replace existing payment systems. Stablecoins, kept at a steady level in relation to another currency, are more frequently used for transactions than traditional cryptocurrencies, confirming their growing role in the payment ecosystem.

Over the years, WEF has become a key platform for global discussion and influences, helping shape policies and decisions that affect the direction of the global economy and society.

Rising adoption

The growing interest and adoption of cryptocurrencies by both financial and technological institutions constitute one of the key driving forces of the crypto market. “Cryptocurrencies are the future of payments, and we want to be part of that future” – said Tim Cook, CEO of Apple, in an interview with The Wall Street Journal in October 2021. Cook revealed that he owns cryptocurrencies and that Apple is considering integrating cryptocurrencies with the Apple Pay service.

In March 2022, MetaMask, one of the most popular cryptocurrency wallets, which saw activity from over 30 million users per month since the beginning of January, introduced support for Apple Pay. As a result, users can now purchase cryptocurrencies directly from their own wallets, further facilitating and enhancing the use of this technology.

In recent years, many well-known companies, including Tesla, Mastercard, PayPal, MicroStrategy, and Facebook, have declared their interest in cryptocurrencies. Many of them invested in Bitcoin as a reserve asset, others introduced services related to buying, selling, and storing cryptocurrencies, and some developed their own projects based on blockchain technology. All of this indicates a growing acceptance of cryptocurrencies and their recognition as an integral part of the global financial system.

“Cryptocurrencies are not just investment assets but also tools for creating new business models and ecosystems based on trust, transparency, and cooperation. As a technology company, we want to be at the forefront of this transformation and support our customers in exploring the opportunities offered by blockchain” – said Satya Nadella, CEO of Microsoft, at the Microsoft Ignite conference in March 2021.

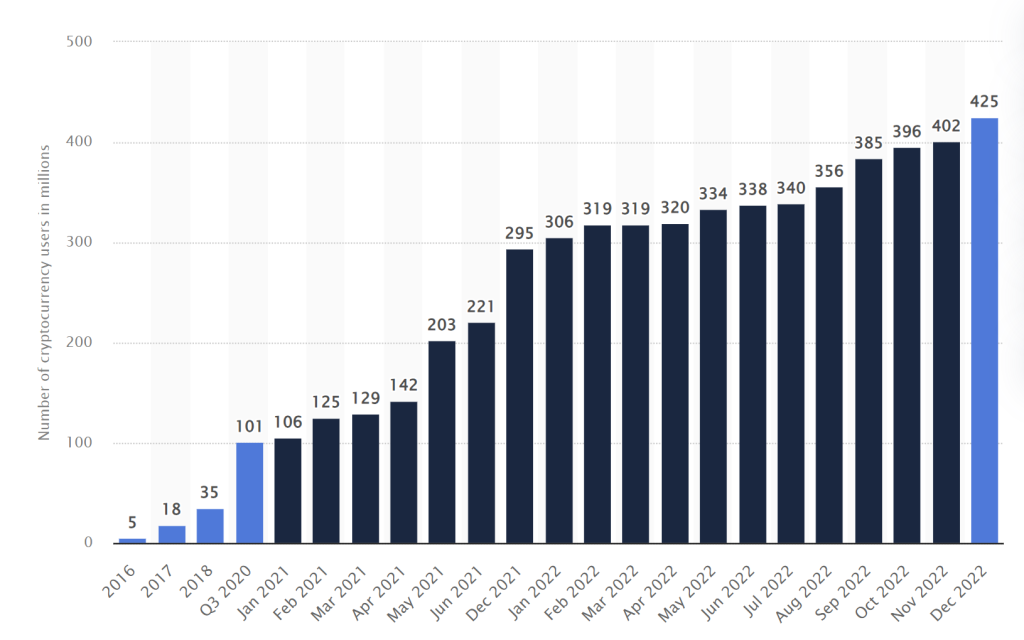

As interest increases, the number of cryptocurrency users worldwide is growing dynamically, bringing with it challenges related to regulations and market volatility. According to Statista data, the number of cryptocurrency users with verified identity has grown from 5 million in 2016 to 425 million in 2022.

Chart: Number of cryptocurrency users with verified identity from 2016 to December 2022.

The global cryptocurrency market, valued at 4.67 billion US dollars in 2022, is expected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% from 2023 to 2030, and the capitalization of the global cryptocurrency market was estimated at over 800 billion US dollars in 2022.

A Coinbase report shows that cryptocurrencies are gaining importance among the largest market players. Over half of the companies from the Fortune 100 list – the largest revenue-generating companies in the United States – are exploring the possibility of integrating blockchain technology into their structure. Since 2020, as much as 52% of companies from this prestigious list are engaging in activities based on cryptography, blockchain technology, and also on Web3 – a new generation of the internet that emphasizes decentralization and tokenization. Since the beginning of 2022, about 60% of companies from the Fortune 100 have already moved to the implementation phase of these innovative solutions or actively started using them.

Companies from the technology, financial, and retail sectors dominate initiatives related to blockchain and cryptocurrencies, accounting for about 75% of all projects since 2020. These companies have invested over 8 billion dollars in crypto-blockchain startups since 2017. The average budget for such projects for 2023 is almost 5.8 million dollars. Most managers expect an increase in investment over the next two years.

Blockchain technology plays a key role in corporate innovations, especially in data management. However, 92% of managers advocating for the creation of new rules for these new technologies indicate that the lack of clear regulations concerning crypto, blockchain, and Web3 technologies pose major challenges to their adoption.

Cryptocurrency sector dynamics

One of the decisive aspects accelerating the growth of the cryptocurrency market is the constant technological progress and innovation in this sector. In recent years, we have seen the emergence of many new initiatives and protocols based on blockchain technology, which propose solutions to many societal problems and needs. Trends such as DeFi (Decentralized Finance), NFT (Non-Fungible Tokens), DAO (Decentralized Autonomous Organizations), Web3 (third generation of the internet), and metaverse (virtual reality) influence this growth. These trends prove that cryptocurrencies not only represent alternative means of payment, but are also tools for creating new business models, communities, and experiences.

The acceptance and expansion of the cryptocurrency sector worldwide are varied and depend on many factors, such as the economic, political, and legal condition of a particular country or region. According to a 2021 report by Chainalysis, global cryptocurrency adoption increased by 880% over the last year, with the largest increases recorded in developing countries such as Vietnam, India, and Nigeria. In these regions, cryptocurrencies are used as a means of exchange, savings, and protection against currency instability or restrictions imposed by the government. Meanwhile, in developed countries like the United States and Germany, cryptocurrencies are often seen as a form of investment or a tool for speculation.

The integration and acceptance of the cryptocurrency sector is also noticeable in the actions of many prominent corporations and financial institutions, which are increasingly investing in cryptocurrencies or introducing services related to them. For example, the Coinbase exchange has teamed up with BlackRock, the world’s largest asset manager, to create an index fund based on cryptocurrencies.

In addition, many luxury brands and fashion industry companies, such as Rolex, Nike, or BMW, have begun considering the possibility of creating their own Non-Fungible Tokens (NFTs) or getting involved in the metaverse – virtual reality based on blockchain technology.

Summary

A Consensys report from June 2023 shows the growing awareness of the global population about cryptocurrencies, with an emphasis on Web3, although full understanding of these concepts is still low. Furthermore, the World Economic Forum (WEF) is studying the impact of cryptocurrencies and stablecoins on macroeconomics, highlighting their potential in creating financial stability, promoting innovation, and sustainable development efforts. There is a growing adoption of cryptocurrencies among technology and financial companies with an increasing number of users worldwide.

The global cryptocurrency market is growing dynamically, with key players like Apple, MetaMask, Microsoft, as well as most companies from the Fortune 100 list, participating in the creation or implementation of blockchain-based solutions. Trends such as DeFi, NFT, DAO, Web3, and metaverse are driving innovation and diversified growth in various regions of the world. Corporations and financial institutions are increasingly engaging in cryptocurrencies, introducing services related to them, and the fashion sector and luxury brands are beginning to explore the possibilities of creating their own NFTs or getting involved in the metaverse.

In the second of a series of three articles, we will take a closer look at how corporate giants – such as Tesla, PayPal, and MicroStrategy – have adopted cryptocurrencies and how these decisions have affected their operations and business strategy. An analysis of benefits such as transaction speed and cost reduction, as well as challenges such as price volatility and regulatory issues, will help us understand how cryptocurrencies are changing the rules of the game in business.

MORE: