Nowadays, cryptocurrencies are not only a subject of investment or speculation but also a practical payment tool, especially in the context of international money transfers. New research conducted by PYMNTS confirms that more and more people are using this digital method of transferring funds – as many as 24% of respondents admitted to sending money abroad using cryptocurrencies.

Why are cryptocurrencies becoming so popular in this area? One of the main reasons is the desire to avoid the classic pitfalls of money transfers, such as high bank fees and waiting times for transactions. Cryptocurrencies offer a fast, and often cheaper, solution for those who want to send money abroad without unnecessary complications.

The demographic factor cannot be forgotten either. Younger generations, who grew up in the digital world, are more open to technological innovations. For many of them, P2P (peer-to-peer) payments are an everyday reality, and cryptocurrencies are a natural extension of this trend. Meanwhile, older generations may be more conservative and distrustful of these innovations.

The European standard of banking services is a luxury.

Europe, known for its developed financial system and easily accessible banking services, often overlooks the challenges faced by residents of other world regions. For many Europeans, the situation of not having access to banking or the necessity to incur high fees for overseas money transfers seems quite absurd. However, this is the daily reality for hundreds of millions of people worldwide.

According to a 2020 World Bank report, global remittance flows to low- and middle-income countries amounted to an impressive $540 billion. This number surprisingly dropped little compared to 2019, indicating the stability and importance of this sector for the global economy.

However, in a global context, access to banking services is not standard. In 2017, about 1.7 billion adults did not have access to traditional banking services. In terms of population, India is one of the countries suffering from the greatest financial exclusion. But that’s not the end of the problem. In Sub-Saharan Africa, nearly 40% of young adults (aged 15-24) also lack access to banks.

Exclusion from the banking system leads to the necessity of using intermediaries, who often charge exorbitant commissions. For those wishing to send money to family left in their homeland, the costs can be significant. In many cases, remittances are a key source of income for families relying on support from relatives working abroad.

Fortunately, innovations have emerged that bring hope. The mobile service M-Pesa, popular in Kenya, is an example of how technology can contribute to a beneficial change in the situation. Thanks to this service, as much as 2% of Kenya’s population managed to escape poverty.

Although Europe enjoys a developed banking system and relatively low transaction fees, many parts of the world still struggle with financial barriers. Supporting innovations that contribute to financial inclusion is key to building a more equitable global financial system.

The problem with traditional financial services lies in the costs.

According to World Bank analysis, the global average cost of sending remittances in the first quarter of 2021 was 6.5%. This is still significantly more than the 3% target set by the United Nations Sustainable Development Goals for 2030. In Sub-Saharan Africa, costs are the highest, reaching 8.2%, while in Europe and Central Asia, they are slightly lower, averaging 5%.

A report by the Bank for International Settlements (BIS) indicates that the value of cross-border payments made through real-time gross settlement (RTGS) systems and net settlement systems (DNS) amounted to an astonishing 156 trillion USD in 2018. However, the costs associated with these payments are not low – the average cost of transferring 1000 USD abroad is about 0.3 USD.

In the European Union, the situation is also far from ideal. Despite witnessing intense economic integration in the EU, the costs of cross-border euro payments average 0.32 EUR, and for currencies of countries outside the eurozone – 7.4 EUR.

Why are these costs so high? Possible reasons include: lack of transparency in fee structures, differences in regulations between countries, limited competition in the financial services sector, and high costs associated with maintaining traditional financial infrastructure.

The mentioned statistics highlight the problem, but also point to the need for action. There are already initiatives aimed at reducing costs through the introduction of price transparency, harmonization of regulations, and promotion of competition. Innovations such as blockchain technology and new forms of digital payments can also play a key role in the future.

Blockchain as a response to the challenges of cross-border transactions

The modern economic world is marked by numerous challenges, of which one of the most pressing is the cost and duration of cross-border transactions. In the era of globalization, where companies from different continents collaborate on a daily basis, efficient and quick financial flows become key to success. We have identified 5 reasons why blockchain technology could be the answer to these challenges.

- Shortening transaction times

As mentioned, an average company in the USA might wait up to 33 days to complete a cross-border transaction, mainly due to outdated and time-consuming manual processes. However, thanks to blockchain technology, certain transactions, like those executed in China, can be completed in just 15 minutes. Blockchain eliminates the need for an intermediary, such as a bank, speeding up the entire process. - Security and Transparency

One of the main advantages of blockchain is considered to be its ability to ensure transparency and immutability. Each transaction is recorded in the blockchain and cannot be altered without the consensus of all network participants. This assures that the funds are transferred exactly where they are supposed to go, without the risk of fraud. - Transaction Costs

Blockchain technology can significantly reduce transaction costs by eliminating intermediaries and by automating and digitizing many processes that were previously done manually. - Real-time Payments

An increasing number of transactions require immediate settlement. Blockchain can support real-time payment services, not only shortening the transaction time but also potentially offering benefits in terms of better financial liquidity for businesses. - Global Adoption

Well-known companies and financial institutions are already investing in and experimenting with blockchain as a tool for cross-border transactions, which may accelerate its adoption on a larger scale.

Shift Towards Cryptocurrencies in International P2P Transactions

“Digital Currency Shift” – this trend indicates a global movement towards the increasing adoption of cryptocurrencies. Not only are consumer payment preferences changing, but also their expectations of payment service providers.

Global trends in finance point to a growing interest in cryptocurrencies as a means of payment, especially in the context of international P2P transactions. Factors such as speed, lower transaction costs, and greater autonomy contribute to the increasing popularity of this new form of currency.

Data shows that as many as 24% of consumers would pay attention to the ability to receive payments in cryptocurrencies when choosing a payment service provider. This percentage significantly increases among those who already use cryptocurrencies for international transactions.

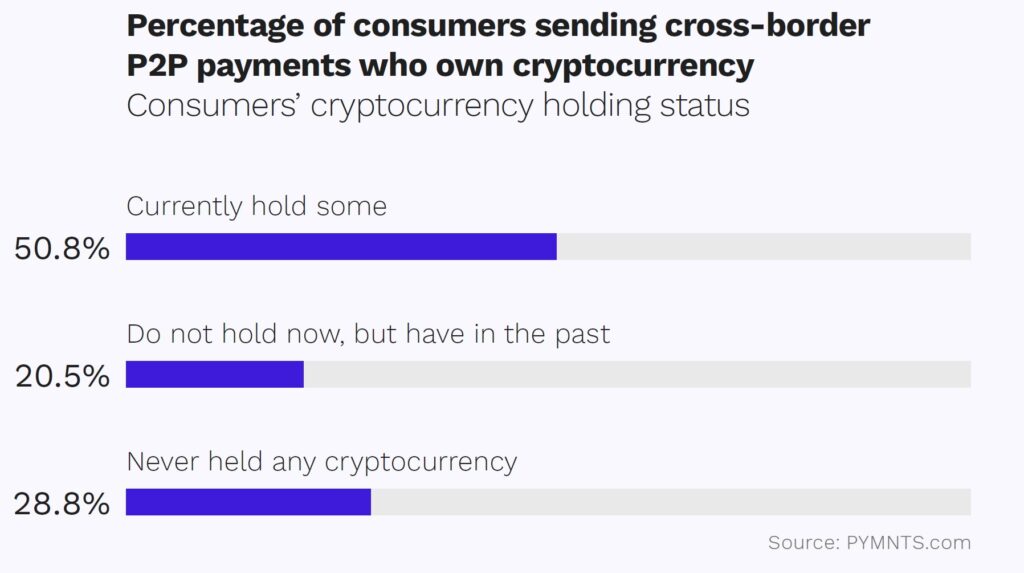

Half of the consumers using international remittances own cryptocurrencies, indicating high adoption of these technologies among those using such services.

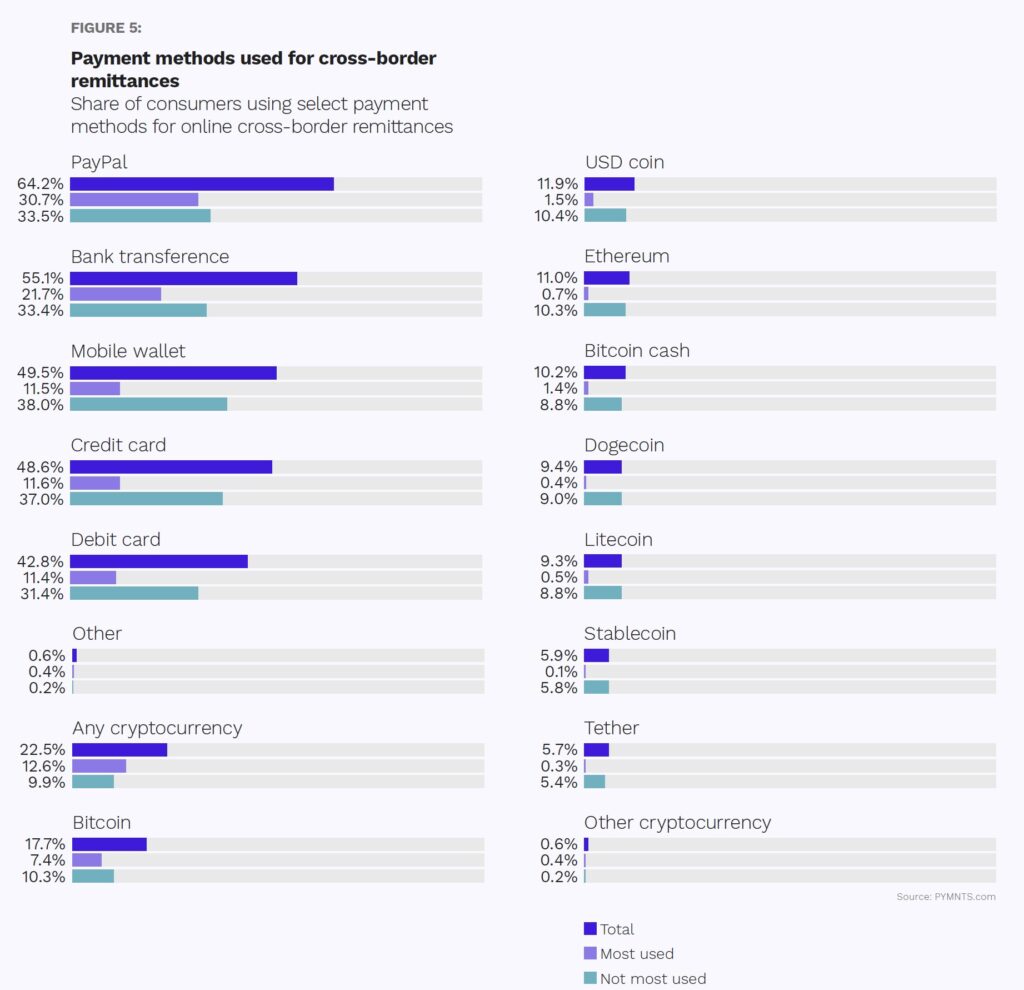

Charts depicting payment methods for international money transfers show a variety of cryptocurrencies used by consumers. While Bitcoin is the most recognizable, other cryptocurrencies like Litecoin, Ethereum, Dogecoin, and Tether are also gaining popularity.

The fact that traditional P2P payment methods can be perceived as slow and expensive gives an advantage to cryptocurrencies, which offer faster and often cheaper solutions.

What does the future hold?

The contemporary financial market is experiencing dynamic changes, especially in the area of international P2P payments. We are witnessing a significant rise in the popularity of cryptocurrencies and payment technologies. Blockchain technology is bringing a breakthrough in transaction processing, shortening the waiting time for the execution of cross-border payments.

The increasing interest in cryptocurrencies for international P2P transactions indicates a fundamental shift in the approach to payments, with an emphasis on speed, cost, and security. This revolution is being led by younger generations, who are more flexible and open to experimenting with new technologies.

We predict that payment technologies and cryptocurrencies will continue their dynamic development, driven by the needs of younger generations for whom speed, accessibility, and cost are key factors. Young people will become the main users of cryptocurrencies and payment technologies, bringing them into the mainstream of the economy.

At the same time, it will be necessary to break down barriers in access and education for older generations. Payment service providers will need to rethink how to build trust and ensure ease of use for users in this age group. It is also expected that legal regulations regarding cryptocurrencies will evolve dynamically, influencing the shape of the market and the way it operates.

In the face of these changes, it will be crucial for payment service providers to adapt to the needs of different social segments, invest in consumer education, and develop innovative and secure technological solutions.