The next Bitcoin halving is expected to occur in April or May 2024. It will be another key moment in the history of this cryptocurrency. Halving aims to reduce the pace at which new coins are created, mimicking the scarcity of precious metals and acting as an anti-inflationary measure.

Halving is an event that approximately every four years halves the reward for miners for mining new blocks in the Bitcoin network. Don’t understand much of it? It is worth looking back to understand the significance of this mechanism, which fits into a broader context of market cycles and cryptocurrency economics.

The history of Bitcoin halvings dates back to 2012, when the first reduction in mining rewards occurred. Since then, successive halvings have occurred and will continue to occur at regular intervals. The difference being that the passage of time is measured in the number of blocks mined:

First Halving: Occurred at block number 210,000.

Second Halving: Happened at block number 420,000.

Third Halving: Took place at block number 630,000.

Fourth Halving: Will occur at block number 840,000.

Each halving has impacted the cryptocurrency market and sparked a flurry of speculation. The first halving in 2012 reduced the block reward from 50 to 25 BTC, the second in 2016 from 25 to 12.5 BTC, and the third in 2020 to 6.25 BTC. After each of these events, the price of Bitcoin significantly increased. The fourth halving, anticipated in 2024, will once again halve the mining reward to 3.125 BTC.

Why does this happen? This is due to the economic fundamentals of Bitcoin. It was created as a response to the inflationary policies of central banks and was intended to become a so-called safe haven – a form of protection of capital against inflation and financial crises. Therefore, unlike traditional currencies, there will never be more than 21 million Bitcoins.

Later in the article, we will explain the monetary properties of Bitcoin, the economics behind it, and why mining is necessary. We will also describe the role of cycles and the impact of halvings on the market and Bitcoin’s price.

Monetary Properties of Bitcoin

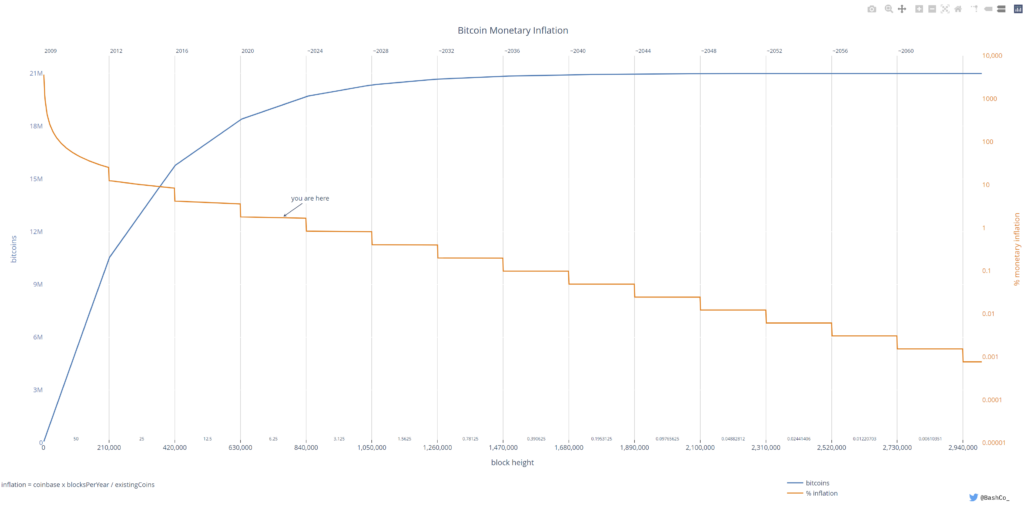

The supply of Bitcoin has been predictably programmed as part of a transparent monetary policy. The growth of the monetary base is illustrated by the following chart:

The currency supply halves every certain number of blocks, ensuring that the total monetary base will never exceed 21 million. This is intended as a response to the inflationary policies of banks.

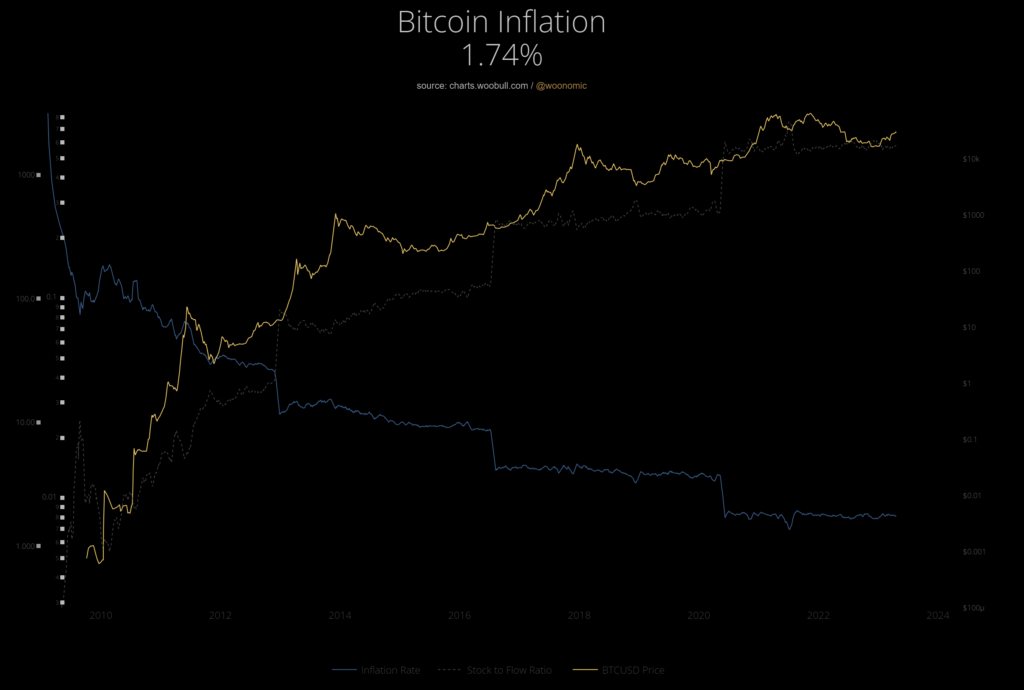

In the case of Bitcoin, despite initially very high inflation due to high emission and a monetary base built from scratch, it currently stands at 1.74%.

By the end of 2023, the monetary base exceeds 19.55 million. Eventually, as it approaches the algorithmically set limit of 21 million coins, Bitcoin will become a deflationary currency. With the decreasing supply over time, miners’ main source of income will become transaction fees, which can be set at will by users.

The “2024 Halving Report” by Blockware Intelligence contains detailed information about the upcoming changes in the Bitcoin ecosystem, especially in the context of the expected block reward split in 2024.

The report emphasizes the role of unique features such as limited supply and algorithmic supply schedule, which cannot be altered. Bitcoin has been compared to gold as a sovereign store of value, but without the flaws of the precious metal. Seven key monetary properties of Bitcoin can be identified:

- Limited Supply. Bitcoin has a set maximum supply of 21 million coins. This means that no more than 21 million Bitcoins can be mined, preventing inflation caused by an excessive increase in supply.

- Divisibility. Bitcoin can be divided into smaller units, known as satoshis. One Bitcoin equals 100 million satoshis, allowing for very small transactions. This becomes particularly useful as the value of Bitcoin increases.

- Decentralization. Bitcoin operates on a decentralized network, meaning there is no central authority controlling its issuance or transactions. Decentralization provides greater resistance to censorship and manipulation.

- Transparency. All Bitcoin transactions are recorded in a public ledger, known as the blockchain. Anyone can review the transaction history, ensuring transparency and helping combat fraud.

- Security. Bitcoin uses advanced cryptography to secure transactions and control the creation of new coins. This makes it resistant to counterfeiting.

- Censorship Resistance. Due to its decentralized nature, Bitcoin is difficult to block or control by any single organization or government.

- Mobility. As a digital currency, Bitcoin is easily portable. It can be traded globally without the need for physical transfer of coins.

Key to understanding the phenomenon of Bitcoin is also understanding its limited supply and increasing demand. Bitcoin was created as an alternative to traditional financial systems, especially as a safe haven in difficult times. Events such as the Cyprus crisis in 2013 and the confiscation of citizens’ deposits by central banks only strengthened its status as a safe haven. Analyzing microeconomic equilibrium theory and the impact of macroeconomic factors helps explain why Bitcoin continues to gain popularity and value.

Why is mining necessary?

Proof of Work (PoW) is a consensus mechanism used in the blockchain that requires participants (miners) to perform work – solving a complex computational problem. This “work” is necessary to confirm transactions and add new blocks to the chain. This mechanism is crucial for the network’s functioning:

- Network security. PoW secures the network against attacks by requiring miners to use significant computational power. To carry out an attack, a fraudster would need to control over 50% of the network’s computational power, which is extremely costly and difficult to achieve.

- Transaction validation. Every transaction in the Bitcoin network must be approved by miners. Mining allows for the verification and approval of transactions without the need for a central trust authority. This is fundamental to the concept of decentralization.

- Issuance of new units. Mining is a way to introduce new cryptocurrency units into circulation while maintaining control over their quantity and rate of issuance. Newly issued coins are a reward for miners for their work.

- Resistance to changes. PoW makes it difficult to manipulate the blockchain, as any change in one block would require recalculating all subsequent blocks. This means that altering or deleting information from the ledger becomes impossible.

In simple terms, Bitcoin mining is the process where transactions are verified and added to the public ledger, known as the blockchain. It uses advanced cryptographic algorithms, where miners use the computational power of their computers to solve complex mathematical puzzles. The first miner to solve the puzzle can add a new block of transactions to the blockchain and in return receives a reward in the form of newly mined bitcoins.

Cyclicality

The “2024 Halving Report” emphasized that the price of Bitcoin is highly cyclical and dependent on major factors such as network adoption, macroeconomic environment, and most importantly – halvings.

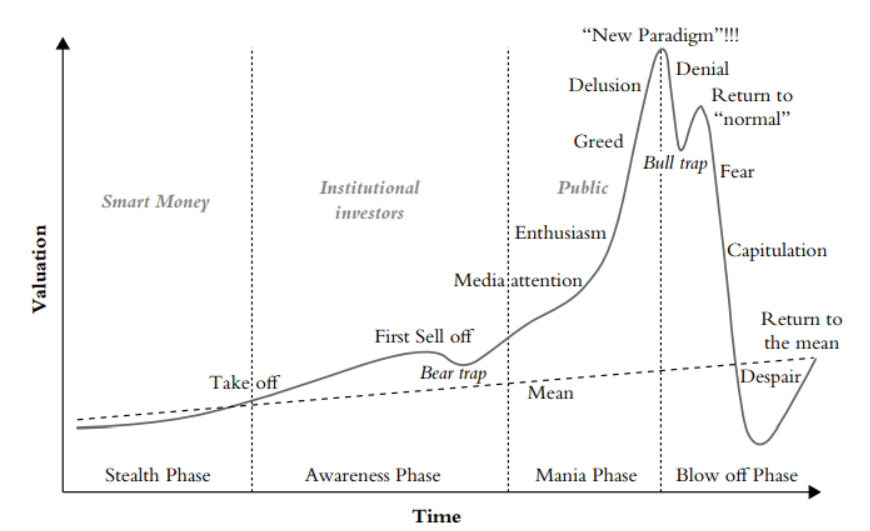

However, Bitcoin’s history is not just a tale of halvings; it’s also a story of sharp price increases and corrections. The Bitcoin market does not develop linearly but rather in waves, similar to the phases of the economic cycle. Each cycle consists of four waves/phases: recovery, prosperity, crisis, and depression. This dynamic nature has led some economists to label Bitcoin a “speculative bubble.” This is rightly associated with the anatomy of a bubble as shown in the following chart:

Nonetheless, it’s worth noting that unlike traditional investment bubbles, Bitcoin price corrections often end with a value higher than before the rise, indicating the cryptocurrency’s enduring growth.

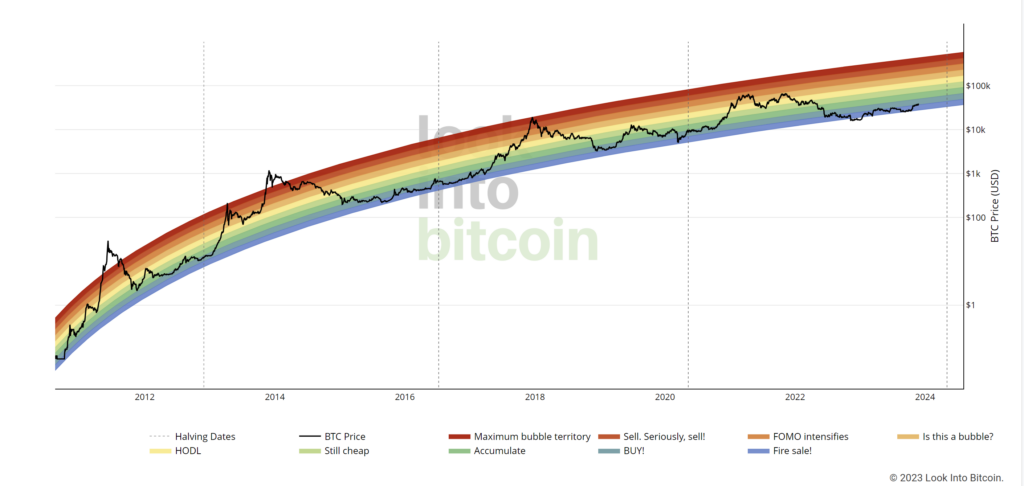

Moreover, looking at the Bitcoin value chart in logarithmic scale (as technology adoption growth should be presented), it’s noticeable that value corrections are completely natural and stem from market characteristics and crowd psychology, similar to other financial markets.

Bitcoin price chart in logarithmic scale:

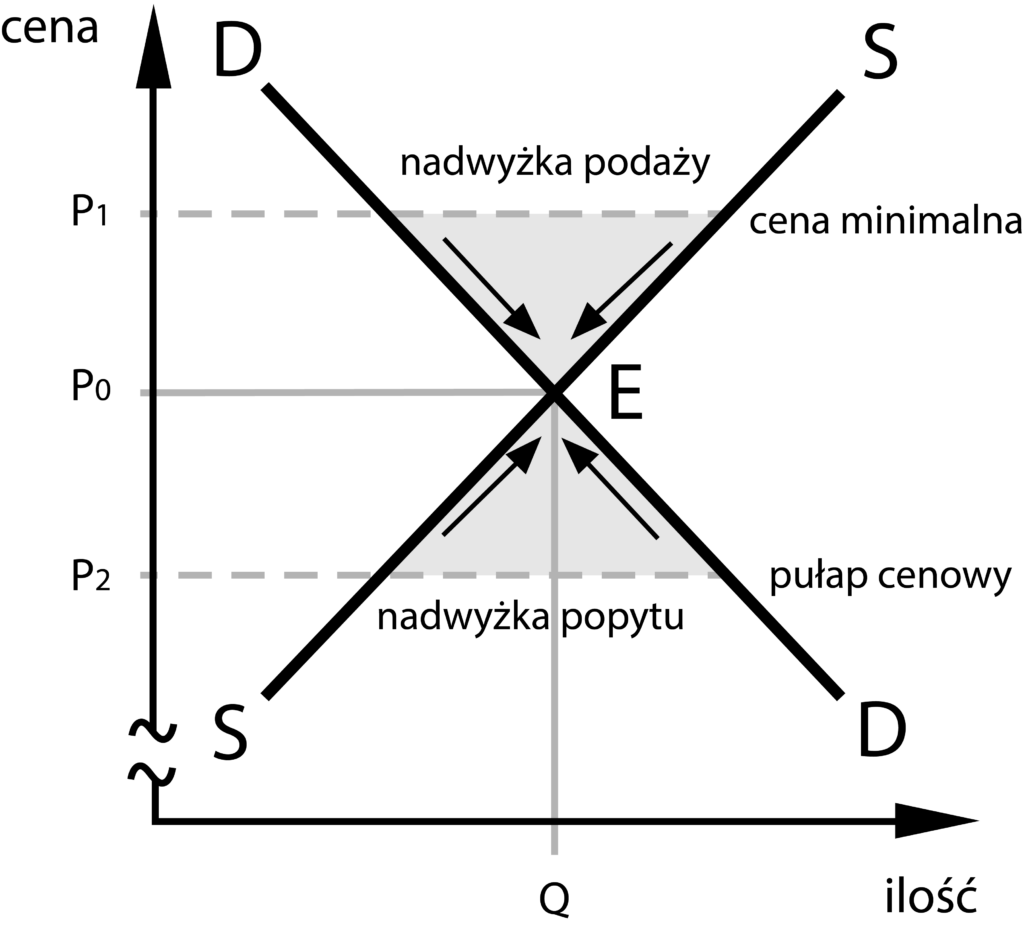

The general theory of equilibrium is an economic concept where the market price results from the interplay of supply and demand, as illustrated in the following chart:

The limited monetary base and increasing demand, according to microeconomic theory of equilibrium, enforce the rise in Bitcoin’s value.

It’s also important to emphasize that the development of technology and technological progress have played a key role in the history of Bitcoin, especially in the context of the cryptocurrency market. As Bitcoin has evolved, information technology and the growth of knowledge have become integral parts of its expansion and adaptation in the global market.

Impact of Halvings on Bitcoin’s Price

In Bitcoin’s history, it’s been observed that after each halving event, its price has surged and the inflation rate has decreased. This change directly affects the dynamics of supply and demand, with historical major Bitcoin price peaks occurring about a year after each halving.

According to tastycrypto.com, immediately after a halving, the price of Bitcoin usually undergoes some correction. Price charts related to halving events are similar and show the following behavior:

- An initial price increase post-halving, lasting from 12 to 15 months.

- A significant correction lasting over a year.

- Moderate growth until the next halving, lasting over a year.

Many people investing in Bitcoin prefer the so-called stock-to-flow (S2F) model to predict Bitcoin’s price. This model was first proposed by a Twitter user, PlanB, in a Medium post.

The S2F ratio reflects the relationship between the existing supply of a commodity and the amount produced in a specific period, such as monthly or yearly. It shows how many years are needed to achieve the current supply, considering the current production rate. The rarer the commodity, the higher the S2F ratio.

For example, gold has the highest S2F ratio among commodities.

PlanB argued that there is a direct correlation between the price of Bitcoin and its S2F ratio, which gradually increases as the pace of issuance slows down due to halvings.

So far, this model has been known for its high accuracy, but it started to deviate from reality since the “crypto winter” of 2022.

According to a Cointelegraph report, the previous Bitcoin halving significantly impacted various aspects of the cryptocurrency ecosystem, from changes in hash rate speed and mining difficulty, miner behavior, to institutional interest and market dependencies.

Potential Consequences of the Upcoming Halving

Although previous halvings had certain similarities, it’s difficult to guarantee that the next halving will lead to a new record high in Bitcoin’s price, especially considering recent deviations from the stock-to-flow model. In the past, PlanB argued that Bitcoin’s price should reach $288,000 after the 2024 halving, but considering Bitcoin’s price at the end of 2023, this seems unlikely.

However, a Blockware Solutions report highlights the importance of the 2024 Bitcoin halving as a potential catalyst for the next bullish market cycle, while also emphasizing Bitcoin’s unique properties as an asset and changes in the mining market dynamics.

It suggests that halving significantly reduces selling pressure from miners, which can lead to price increases. The reduction in supply of new Bitcoins and the withdrawal of less efficient miners lead to increased margins for the remaining ones. The report predicts that the 2024 halving may be a catalyst for another parabolic Bitcoin bull run, with the possibility of reaching prices much higher than the current ones.

It’s suggested that with each successive halving, the effect of reducing selling pressure could be more pronounced, potentially leading to larger price increases in the future.

The reduction in miners’ rewards and the associated increases in mining costs will have a significant impact, especially on smaller mines. Tastycrypto predicts that if price increases after the halving are delayed, the network speed might fall by about 30% due to the closure of unprofitable mines.